EnterpriseAlumni Lead Tech and Investment Ecosystem In Urging UK Government to Reconsider Legislation

The Times: Female ‘angels’ have their wings clipped

Published: February 1, 2024

The UK government rolled out legislation on January 31 that redefines what a high net worth individual means and will see a drop in the number of women eligible to invest in businesses via angel groups. This will have a significant impact on women-owned businesses in particular as with under 2% of venture capital allocated to female led businesses, women typically rely disproportionally on this sort of funding.

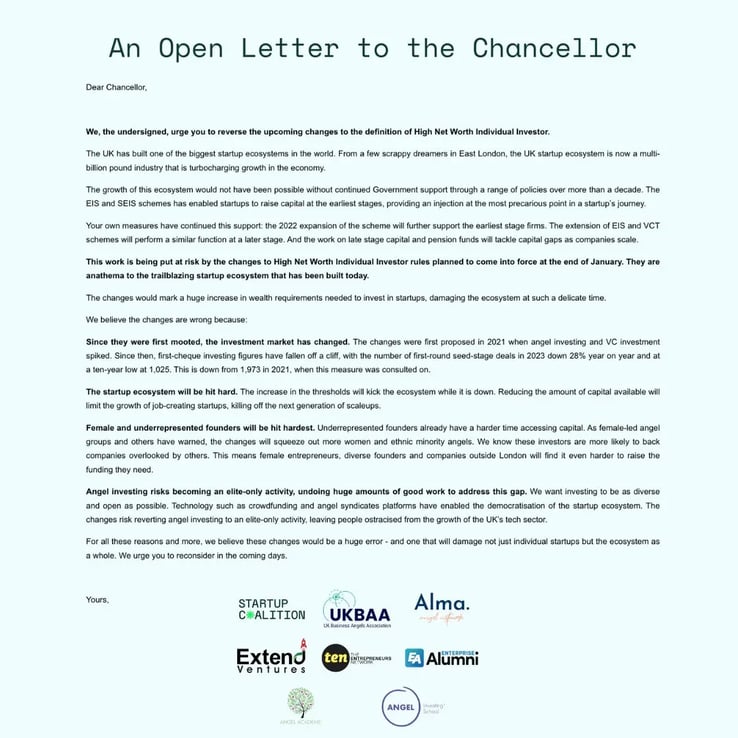

EnterpriseAlumni CEO Emma Sinclair is leading the charge on this adverse shift with the UKBAA, Start Up Coalition, Angel Academe and others, spearheading efforts to remove this new obstacle to funding.

The UK has built one of the biggest startup ecosystems in the world. From a few scrappy dreamers in east London, the UK startup ecosystem is now a multi-billion pound industry that is turbocharging growth in the economy.

The growth of this ecosystem would not have been possible without continued Government support through a range of policies over more than a decade. The EIS and SEIS schemes have enabled startups to raise capital at the earliest stages, providing an injection at the most precarious point in a startup’s journey. Eliminating or reducing female investors and raising the barriers to investing is a step backwards.

Read An Open Letter to the Chancellor and the subsequent article in The Times by Hannah Prevett digging further into this topic.